| Bitcoin Difficulty Jumps - A 50% Miner Is Possible |

| Written by Mike James |

| Wednesday, 30 December 2015 |

|

Bitcoin is one of the most interesting algorithmic experiments ever. It has a unique mix of clever procedures designed to stop cheating, however it is difficult to say if they are effective, not because of technology but psychology. Now we seem to be entering a new phase with hardware good enough to take control of the entire protocol.

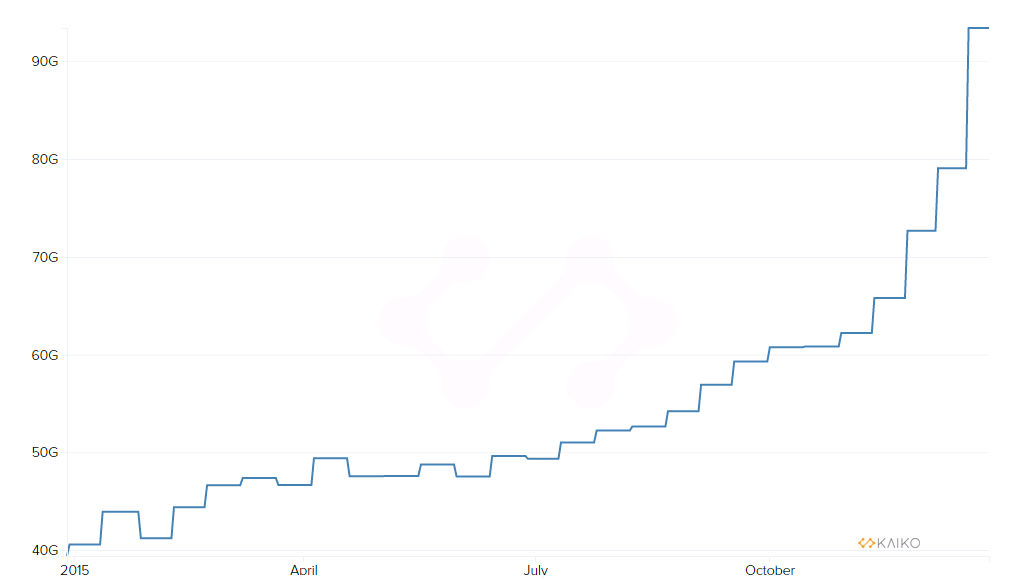

One of the many interesting things about the bitcoin algorithm is the use of a proof of work mechanism to pick in a random style the agent that gets to validate a block to be added to the block chain. To remind you of what proof of work is all about: bitcoin miners compete for the right to validate a block of transactions. To do this they have to add data to the transactions to make a hash function, SHA-256, work out to a given value when applied to the block. One of the interesting things about this particular proof of work task is that its difficulty can be adjusted by setting the target value. Every two weeks or so the difficulty is adjusted to keep the average time for the task at about 10 minutes. Now consider the implications of this very simple idea. The miners are all competing to be first and they are rewarded with some new bitcoins when they are successful. This creates an arms race with miners trying to improve their mining techniques so that they get there first. Mostly the improvements have been to the hardware that miners use. Back in the early days of bitcoin you could mine a block using a desktop PC, then you needed a GPU to have a chance of making a profit. Currently dedicated, custom-built mining, machines are your only hope and you need a data center full of them.

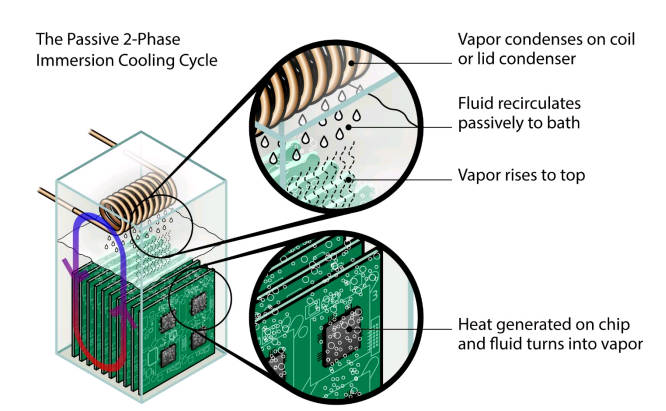

What this means is that the difficulty has increased fairly steadily over the life of bitcoin. Suddenly, however, the difficulty has jumped by over 40% in one month. The reason is most likely due to a new mining operation - BitFury - starting to function. BitFury is using a new mining ASIC, a custom chip, to compute the hash. Its new data center is a state of the art facility with liquid-cooled machines to cram in as much hardware as possible. It is estimated to have cost $100 million and is located in the Eastern European country of Georgia in a special state-created technology zone. It makes use of 20M watts of power when mining at full capacity.

It seems likely that BitFury's data center also has the capacity to go beyond the 50% mining capacity needed to make bitcoin vulnerable ot central control. The theory is that as long as no single miner commands 50% of the mining power then bitcoin cannot be manipulated in ways that are dishonest. The reason for this is that with less than 50% mining power no miner can be sure enough of completing the very next block to be able to pervert the ledger. The point is that proof of work keeps bitcoin decentralized and under no one miner's control. If one miner has more than 50% then bitcoin immediately changes its status to a centrally administered ledger. This seems like a clear cut sort of situation, but in practice it isn't. For example, bitcoin enthusiasts argue about exactly what a dishonest miner would do with their centralized control? Most often the suggestion is that they could arrange for double spending of the same bitcoin. There are many other suggestions, including blocking the processing of transactions from particular sources unless a higher transaction fee is paid. However, what is clear is that it is difficult to predict what a controlling miner would do to maximize their profits. Many argue that the whole situation is one something like Mutually Assured Destruction - any miner tempted to be dishonest, controlling or not, would wipe out their profit by destroying any confidence in the currency. There is also the point that a more than 50% control is almost certainly going to be a temporary situation. The reason is simply that mining is an arms race. With the other miners' incomes reduced by BitFury's success they will have to invest to continue to make a profit. It is also clear that BitFury has set the going rate for buying 50% of the mining resources - $100 million is all you need. There is one small worry. Over time the number of bitcoins provided as payment reduces - and it is set to halve sometime in 2016. As the mining payment reduces, the incentive for the arms war reduces. In theory the miners can start charging a transaction fee to make up for the lost bitcoin, but it isn't clear how this is going to work out. One thing is clear the transition will reveal the true cost of mining. More InformationRelated ArticlesLinux Foundation Backs Blockchain Project bitcoin Course Offered Free Online bitcoin Fork Due To Algorithmic Differences bitcoin Isn't As Anonymous As You Might Hope The True Cost Of Bugs - bitcoin Errors Inside bitcoin - virtual currency

To be informed about new articles on I Programmer, sign up for our weekly newsletter, subscribe to the RSS feed and follow us on, Twitter, Facebook, Google+ or Linkedin.

Comments

or email your comment to: comments@i-programmer.info

|

| Last Updated ( Wednesday, 30 December 2015 ) |