| Present and Future Values |

| Written by Janet Swift | |||||||

Page 6 of 6

Including all of the paymentsThere seems to be a contradiction contained in the previous section. In Chapter Six we worked out the formula for a repayment loan based on the fact that its future value was zero and yet in the last section the idea that a repayment loan has a large positive future value was introduced. The difference is that in in the previous chapter we included the amount of the loan as the first amount in the cashflow. That is, the cashflow was assumed to start with a negative amount equal to the loan. If you include the initial negative amount in either the repayment loan or the annuity then we no longer have the simple regular cashflow that was analysed in the previous section. Fortunately it isn’t too difficult to arrive at similar results but they are different. Now that we have a general definition of the NFV and a relationship between the NPV and NFV we can re-examine the repayment loan and the annuity including their initial payments. Notice that in both cases the first cashflow occurs right at the very start of the investment, that is at the start of the first period. This means that in the calculation of the NPV you simply include the first cash amount without the need to discount it. This is true of any sort of investment that involves an initial deposit which then generates a series of cashflows. That is:

If you include the amount of the loan or the purchase price of an annuity as the first item in the cashflow the NPV is zero. The reason is quite simply that the NPV of the cashflow is equal to the loan or purchase price as discussed earlier. To see that this is so let’s look at an example. If you borrow $1000 for 5 years at 10% (effective) per annum the repayments are $263.80 annually for 5 years. Taking the cashflow as five yearly payments (at the end of each year) of $263.80, we can ask what the present value of this cashflow is:

i.e. the amount of the loan. If we now include the loan in the cashflow as an initial -1000 outflow of cash then the Net Present Value is -1000+1000 which is of course $0. This is also the result computed by the NPV function as long as you remember to include the initial sum separately. If we include the initial amount of the loan as a negative sum then it is clear that the Net Future Value of a repayment loan is also zero. Once again an example will make this clear. If you borrow $1000 at 10% per annum to be repaid over 10 years then repayments are $162.75 per annum and the Net Future Value is:

which works out to zero. You can arrive at the same conclusion by recalling the fact that the NFV is also given by the NPV invested at I% for the same period. Of course this implies that if the NPV is zero then then the NFV also has to be zero. The same sort of reasoning applies to an annuity. If you include the initial deposit needed to fund the annuity then its present value and its future value are both zero. In the case of a savings plan there is no initial deposit and so the earlier interpretation of the present and future values hold. What is important here is that we get different answers depending on whether or not we include all of the cash sums involved in a transaction. It is perfectly reasonable to analyse the cashflow that results from a transaction like a repayment loan in isolation from the value of the loan. It is also perfectly reasonable to analyse the cashflow including the loan but not only are the results different but they have to be interpreted in different ways. Key points

Financial Functions

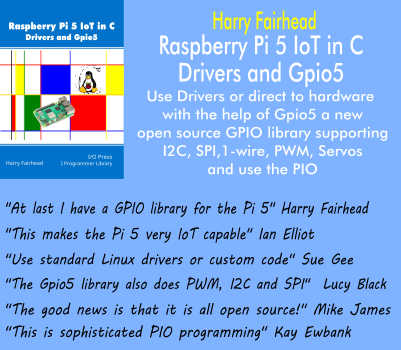

Buy from AmazonSpreadsheets take the hard work out of calculations, but you still need to know how to do them. Financial Functions with a spreadsheet is all about understanding and reasoning, using a spreadsheet to do the actual calculation.

<ASIN:1871962013> <ASIN:B07S79ZVMQ> To be informed about new articles on I Programmer, sign up for our weekly newsletter, subscribe to the RSS feed and follow us on Twitter, Facebook or Linkedin.

Comments

or email your comment to: comments@i-programmer.info <ASIN:1118490444>

|