| Simple and Compound Interest - Time Is Money |

Page 4 of 5

The Half Life Of MoneyTo give you an example of how the other compound interest formulas can be used how would you calculate the number of years it takes for the value of money to exactly halve, given any particular inflation rate? This is just a matter of using the formulas that gives n in terms of PV, FV and I. That is, time to half value is:

which simplifies to:

or using the NPER function:

For example, if inflation is 6% then the number of years to halve the value is:

or using the NPER function and a nomial present value of $100:

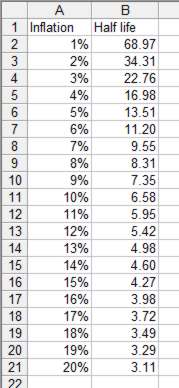

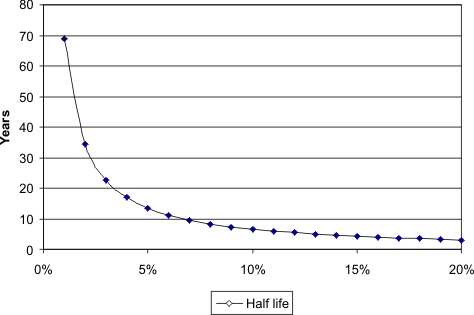

both of which work out to 11.2 years. Notice that it is important to remember that the inflation rate is treated as a negative rate in all of the compound interest formulas - hence the -0.06 or -6% in the above. The time it takes inflation to reduce the value of currency to 50% of its original value could be called the `half life’ because it is exactly analogus to the definition of the half life of radioactive elements. How the inflation rate determines monetary half life is quite an useful way of trying to gain an understanding of the effects of inflation. It is quite easy to construct a spreadsheet that tabulates half life, see Figure 6.

The half life of money Enter the labels and data as shown in column A and B1 and the formula

into B2 and then copy it from B2 into B3..B20. It also helps to examine the half life using a graph. This makes it quite clear that the largest changes in half life occur when the inflation rate is small. With inflation running at 10% or more money loses half its value in less than 7 years and if the inflation rate hits 30% it halves the value of money in less than 2 years.

The half-life of money during inflation

Inflation and interestIt is obvious that inflation and interest pull the value of an investment or loan in different directions. To make a true appraisal of value it is important to look at inflation adjusted estimates of FV. Notice that when it comes to interest it is possible for the calculation to be exact and determinate but but once inflation is considered we really are dealing with estimates of worth. Fortunately the calculations are very easy. If you invest PV at I% for Y years compounded monthly then the FV is:

If inflation is running at F% per annum the FV will only be worth:

Putting these two together gives the estimate of FV in today's terms as:

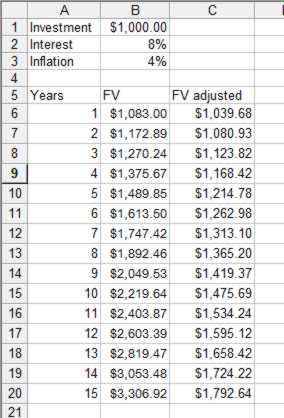

Although this looks like a very complicated formula you can easily make use of it in a spreadsheet to calculate the effects of inflation on an investment or loan. Notice that, as pointed out in Chapter 1, percentages and percentage rates do not add. So for example, an interest rate of 10% coupled with an inflation rate of 2% doesn’t produce an effective rate of 8% - but you will still often hear, and even read, this sort of reasoning! Another common error is to assume that if inflation is running at 10%, say, then an interest rate of exactly 10% will offset its effects. This is another example, of the 10% decrease cancelling a 10% increase discussed in Chapter 1 and it is as wrong when applied to interest rates as when it is applied to percentages! If inflation is running at x% then an interest rate of x% still results in an overall loss of value of a deposit. If you would like to investigate this statement for yourself then you need the following spreadsheet. Investments and loans with inflationUsing the standard compound interest formulas it is easy to put together a spreadsheet that will tabulate the real gain on an investment over any time period as shown below:

First enter the text and values shown in column A and row 5. The formula:

should be entered into B6 and copied into B7..B20 and

should be entered into C6 and copied into C7..C20. Cells B1 and B6..C20 should be set to currency format and B3 and B4 to percentage format. Notice the use of absolute cell references in the formula. Also notice that the FV adjusted for inflation has been calculated in two stages rather than using the full formula given earlier. It is often better to break a complicated calculation down into smaller stages that can be checked and edited more easily. You can, of course extend this spreadsheet to cover any number of years simply by copying the formulas into additional rows. Once again notice that this calculation applies to loans as well as investments. In either case it is the borrower rather than the lender who benefits. For example, in the situation shown in the screen dump if the principal was borrowed at 8% per annum to be repaid in full including interest in 15 years then, although the paper value of the repayment is $3307, it should only `feel like’ $1793. Thus inflation erodes debt as well as wealth! Of course the results of this spreadsheet have to be interpreted carefully because they depend on the estimated value of future inflation. While you might be confident about future interest rates, inflation is a far less controllable quantity. In practice inflation will vary over the period of the calculation and so the results are only approximate, even if you use an estimate of the average inflation. Inflation is discussed again in more detail in a later chapter.

<ASIN:0471747483> <ASIN:0202309231> <ASIN: 0471267686> <ASIN: 073562304X> <ASIN:0470042907> |