| Bitcoin Is Not The Only Cryptocurrency |

| Written by Mike James |

| Wednesday, 17 May 2017 |

|

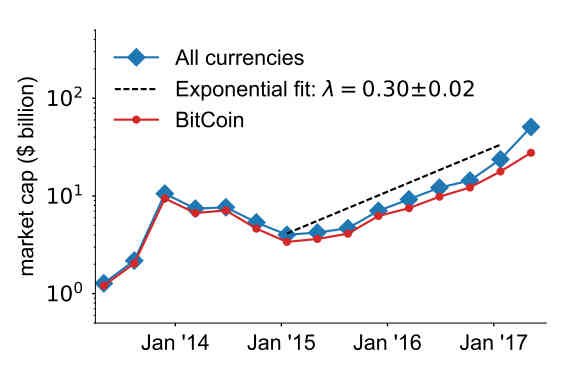

The rise of the cryptocurrency is a phenomenon worth study. It came out of nowhere and the fear is that it might well go back to nowhere, leaving lots of people with a huge loss. Can physics help to explain the dynamics? Of course it can! Physics explains everything, and to paraphrase a recent protest slogan, it doesn't matter if you believe in it. Several researchers - Abeer ElBahrawya, Laura Alessandrettia, Anne Kandler, Romualdo Pastor-Satorrasc and Andrea Baronchelli, have studied the dynamics of the entire market. You may think only of Bitcoin but there is an ecosystem of different cryptocurrencies and they keep being born: The cryptocurrency market has reached a record of $54 billion in 2017 after months of steady growth. However, a comprehensive analysis of the whole system has been lacking so far, since most studies have focused on the behaviour of one (Bitcoin) or few cryptocurrencies. Here we consider the entire market and analyse the behaviour of ∼ 1, 500 cryptocurrencies introduced since April 2013. What is interesting is what allows a currency to acquire value and equally what makes it lose any value it had. From a technical point of view, what motivates many a cryptocurrency launch is tinkering with the algorithm - the block chain in particular. Many cryptocurrencies launch because their designers believe that have a better block chain algorithm and the currency is simply a proof of concept. However, who could resist creating a currency from nothing that grew to millions of dollars in value - especially if you had a few coins set aside. Interestingly the coins that the pseudonymous inventor of Bitcoin, Satoshi Nakamoto, kept for himself have never been spent. He is estimated to own one million bitcoins with a current worth of $1.7 billion. The first analysis reveals that cryptocurrencies have entered a stage of exponential growth in market capitalisation.

The dashed line is an exponential curve f(t) ∼ e λt, with

What is clear from this chart is that the confidence is in all cryptocurrencies, and not just Bitcoin. You can also detect that Bitcoin is losing market share: Bitcoin market share has been steadily decreasing for the past years, beyond oscillations that might mask this trend to short-term investigations. The decrease is well described by a linear fit f(t) = a+bt with angular coefficient b = −0.035±0.002 representing the change in market share over t = 1 year. This would predict Bitcoin market share to fluctuate around 50% by 2025, although of course very likely non-linear effects will modify this picture. The data also reveal that the number of cryptocurrencies seems to remain remarkably stable across time. After an initial spike in the "birth" rate close to when Bitcoin was introduced, both birth and death rates are fairly constant. To explain this, the idea of cryptocurrency ecology is introduced along with a neutral evolution model. The model is remarkably simple - individuals correspond to fixed amounts of dollars and species correspond to different cryptocurrencies. New cryptocurrencies are created with a probability 7/N where N is the population size and the time step is one week and the simulation starts off with a single species, namely Bitcoin. Despite being simple, the model seems to fit quite well and reproduces the market share distribution. The conclusion of the paper says: We have shown that the total market capitalisation has entered a phase of exponential growth one year ago, while the market share of Bitcoin has been steadily decreasing. We have identified several observables that have been stable since the beginning of our time series, including the number of active cryptocurrencies, the market-share distribution and the rank turnover. By adopting an ecological perspective, we have pointed out that the neutral model captures several of the observed properties of the market. And interestingly, if you are thinking of inventing a better Bitcoin: the good match with at least part of the picture emerging from the data does suggest that some of the long-term properties of the cryptocurrency market can be accounted for based on simple hypotheses. In particular, since the model assumes no selective advantage of one cryptocurrency over the other, the fit with the data shows that there is no detectable population-level consensus on what is the “best” currency or that different currencies are advantageous for different uses. Does this suggest that there is no point in inventing a better Bitcoin or just that, to date, no one has done it?

More InformationBitcoin is not alone: Quantifying and modelling the long-term dynamics of the cryptocurrency market Related Articles//No Comment - The Balance Attack Against Proof-Of-Work Blockchains Doubt Over Craig Wright's Claim To Be Bitcoin Inventor - Updated Bitcoin - A Failed Experiment. Inside Bitcoin - The Block Chain Stanford Bitcoin Engineering MOOC Proposed Bitcoin Difficulty Jumps - A 50% Miner Is Possible Linux Foundation Backs Blockchain Project Replace By Fee - Bitcoin Modifications bitcoin Course Offered Free Online bitcoin Fork Due To Algorithmic Differences bitcoin Isn't As Anonymous As You Might Hope The True Cost Of Bugs - bitcoin Errors Bitcoin Almost Crashed - But Lived To Crash Another Day

To be informed about new articles on I Programmer, sign up for our weekly newsletter, subscribe to the RSS feed and follow us on Twitter, Facebook or Linkedin.

Comments

or email your comment to: comments@i-programmer.info

|

| Last Updated ( Wednesday, 17 May 2017 ) |