| Exploring Repayment Loans |

| Written by Janet Swift | ||||

Page 3 of 3

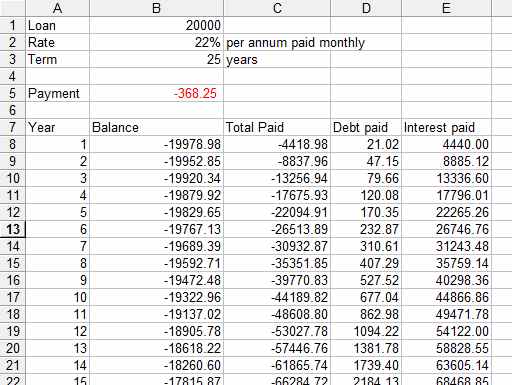

Loan schedule calculatorUsing these formulas it is quite easy to put together a spreadsheet that will detail the state of a repayment loan at any stage in its life. The only real problem is allowing for the required number of months in the table. First enter all of the text and Loan, Rate and Term data as shown in the screen dump. Enter 1 in A8 to start the formula off and enter: =FV($B$2/12,A8*12,$B$5, $B$1) in B8 =$B$5*A8*12 in C8 =$B$1+B8 in D8 =-(C8-D8) in E8 The first formula computes the state of the account at the end of each year. The second works out the total amount paid by the end of the year and the final two work out the amount of the debt paid off and the amount paid in interest to date. Next fill column A with as many year numbers as you are interested in and copy the formulas in B8:G8 into the same number of rows. You can see an example of a 25-year loan in the spreadsheet. Notice the way that the first year's payments only succeed in paying off $21.02 of the principal even though over $4400 is paid! Over the 25-year period of the loan more than $130,000 is paid in interest.

The basic loan spreadsheet

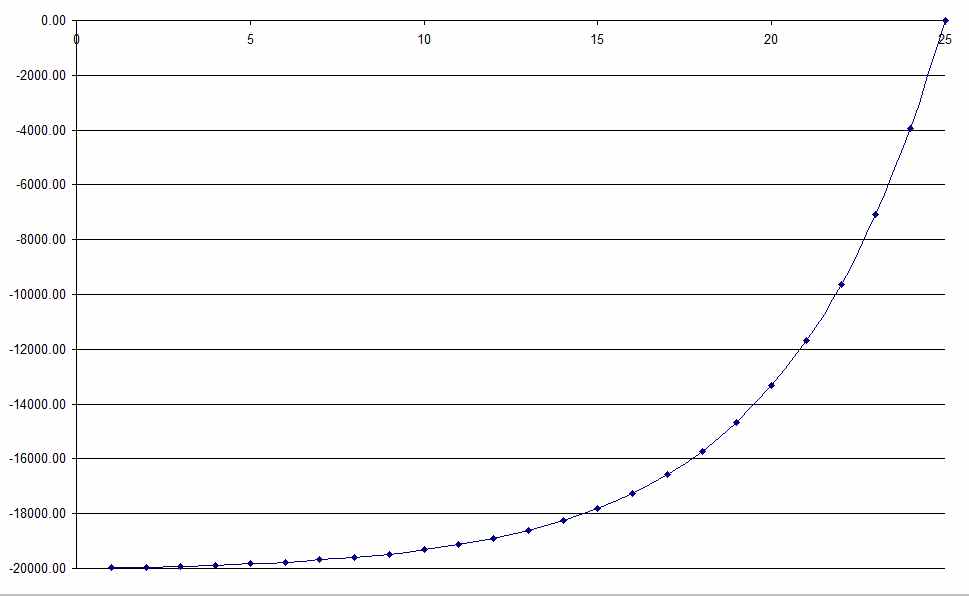

Loan balance reduction over timeThe way in which loan repayments affect the amount you owe is much easier to appreciate in a chart which can be constructed directly from this spreadsheet with Year (Column A) on the x-axis and Balance (Column B) on the y-axis. If you look at the graph of the balance against time you can see the characteristic shape of the repayment loan. The principal is paid off only slowly at first but the speed of repayment increases dramatically in the final years.

The rate of decrease of a repayment loan Notice that there is no real decrease in the amount owed for the first 15 years. This is the reason why additional payments early in the life of a loan can greatly reduce the total cost.

Financial Functions

Buy from AmazonSpreadsheets take the hard work out of calculations, but you still need to know how to do them. Financial Functions with a spreadsheet is all about understanding and reasoning, using a spreadsheet to do the actual calculation.

<ASIN:1871962013> <ASIN:B07S79ZVMQ> To be informed about new articles on I Programmer, sign up for our weekly newsletter, subscribe to the RSS feed and follow us on Twitter, Facebook or Linkedin.

Comments

or email your comment to: comments@i-programmer.info

<ASIN: 0470475366> <ASIN:1118510100> <ASIN:0735672431> <ASIN:0789748576> <ASIN:0470178892> <ASIN:0195301501> <ASIN:1119067510>

|